Top Stocks Soaring to Their 52-Week Highs: Is Now the Time to Invest?

Investing in stocks reaching their 52-week high can be exciting and strategic. These stocks have shown strong performance over the past year, often signaling bullish momentum. But how do you decide if they’re worth investing in? Let’s break it down simply.

What is a 52-week High?

A 52-week high is a stock’s highest price over the past year. When a stock hits this milestone, it usually attracts attention from investors and analysts, as it can indicate strong market confidence or positive fundamentals.

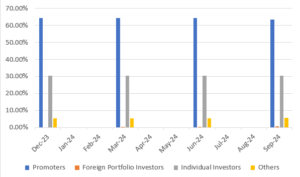

Ownership Patterns to Watch for 52-week High

When analyzing 52-week high stocks, checking ownership patterns can provide valuable insights:

- Institutional Investors: A rise in mutual funds or foreign institutional ownership often signals confidence in the stock’s potential.

- Promoter Holdings: Consistent or increasing holdings by company promoters show trust in the company’s long-term growth.

- Retail Participation: A significant retail investor interest could indicate hype but requires cautious analysis.

Should You Invest in 52-Week High Stocks?

Here’s how you can evaluate:

- Check Fundamentals: Ensure the company has strong financials like revenue growth, profit margins, and manageable debt.

- Look Beyond the Hype: Avoid buying solely based on momentum. Investigate whether the stock’s rise is supported by sustainable growth.

- Assess the Market Sentiment: Understand if the high is due to temporary trends or long-term potential.

Final Thoughts

it’s essential to approach them with a clear strategy. Pay attention to ownership patterns and fundamentals to separate strong contenders from speculative risks.

“Remember, every high carries the potential for a correction—so invest wisely and always diversify your portfolio.”

You can check 52-week high stocks using the following link https://chartink.com/screener/52-week-high-stocks

Pingback: Hot High Dividend Yield Stocks FY24: IOC, Hyundai Motor, Vedanta Lead the Pack - smartstockinsights