Amber Enterprises India Surges 20% in Two Days: What’s Driving the Rally?

Amber Enterprises India Limited, a leading player in the air conditioning and refrigeration industry, has delivered an impressive 20% return to its investors in just two trading sessions. The surge in stock price has caught the attention of market participants and raised questions about the factors fueling this meteoric rise.

Let’s dive into Amber Enterprises’ key reasons behind this extraordinary performance and what it could mean for investors moving forward.

-

Strong Quarterly Performance: Amber Enterprises recently announced robust quarterly results, exceeding market expectations. The company reported significant revenue growth, driven by increased demand for its air conditioning and refrigeration solutions, coupled with operational efficiency improvements. This financial outperformance has boosted investor confidence and attracted fresh buying interest.

-

Favorable Industry Trends: The Indian consumer durables sector is witnessing a revival, with increasing urbanization and rising disposable incomes fueling demand for air conditioning and cooling products. Government initiatives promoting energy efficiency and local manufacturing under the “Make in India” campaign have further positioned Amber Enterprises as a beneficiary of these tailwinds.

-

Strategic Partnerships and Expansions: Strategic Partnerships and Expansions Amber Enterprises has been actively expanding its portfolio and forging strategic partnerships to strengthen its market position. Recent announcements about collaborations with global brands and investments in state-of-the-art manufacturing facilities have reinforced its growth narrative. These developments have resonated well with the market, adding to the positive sentiment.

-

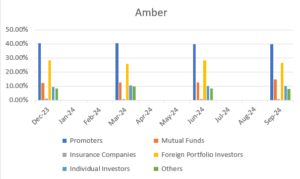

Institutional Buying: The stock’s recent rally has also been supported by strong institutional buying. Analysts believe that large domestic and foreign institutional investors have increased their stake in Amber Enterprises, reflecting their confidence in the company’s long-term growth potential. The increased demand has contributed to the sharp price appreciation.

-

Latest News: Adding to the momentum, Amber Enterprises recently announced its plans to expand its manufacturing capacity with a new facility in Tamil Nadu. The plant is expected to focus on producing energy-efficient air conditioning components, aligning with the government’s emphasis on sustainability and local manufacturing. Additionally, the company has secured a significant order from a leading multinational corporation, further bolstering its revenue visibility for the upcoming quarters.

Ownership pattern of Amber Enterprises:

What Should Investors Do?

While the recent rally is undoubtedly impressive, investors should exercise caution before jumping in. It’s essential to evaluate the stock’s fundamentals, current valuation, and broader market conditions. For long-term investors, the company’s growth potential in the air conditioning and refrigeration segment makes it an attractive prospect, but short-term volatility should not be overlooked.

In conclusion, Amber Enterprises India’s 20% return in two days underscores the stock’s potential as a strong performer. By keeping an eye on future developments and aligning investment strategies accordingly, investors can make informed decisions to capitalize on such opportunities.

also refer below link for more post:

https://smartstockinsights.in/

https://smartstockinsights.in/2024-will-it-lead-psu-stocks-again-in-2025/

For stocks analysis use below link

https://www.screener.in/company/AMBER/consolidated/